Is AI drug discovery more hype than hypothesis? 🧪

Jan 15, 2026

Kaley Ubellacker

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

What's happening at Necessary Ventures:

Infinite Machine's Olto was also named one of Time Magazine's Best Inventions for 2025.

Worth checking out for Emerging GPs:

Catalyze opened applications for its 2026 Catalyze Fellowship Fund. The six-month program welcomes 5-10 first-time GPs across private markets, offering them 1:1 operational support and access to a network of experts, mentors, and LPs.

Good Reads 📖

For the rushed reader …

AI drug discovery hasn’t been the quick win investors hoped for, despite more than $17 billion poured into the sector since 2019.

After decades of slow growth and costly overruns in nuclear, a new wave of startups is betting on smaller, modular reactors to make nuclear power more scalable.

Startup 1X unveiled its World Model, a video-based AI system that allows its NEO humanoid robot to teach itself entirely new physical skills.

For the less rushed reader …

Trial and error

Investors were hoping for a fast pill, but it looks like AI drugs are more slow release. AI drug discovery hasn’t been the quick win investors hoped for, despite more than $17 billion poured into the sector since 2019. Startups like Isomorphic Labs and Chai Discovery are making progress designing candidate therapies with AI, but translating models into clinically viable drugs remains a long, costly, and failure-prone process. In fact, data shows 85% of candidates fail in trials. Experts note the core bottleneck isn’t compute, but deep knowledge of human biology, messy datasets, and the complexity of protein structures. AI can accelerate early-stage discovery but cannot reliably predict safety, efficacy, or dosing. While some AI-designed candidates are in early trials, the payoff for investors may take years. Still, breakthroughs like AlphaFold 2 show the field is advancing, and those who persist through the slow timelines could gain an edge when AI finally delivers on its promise. Does the age-old phrase “everything in moderation” apply here?

Fission impossible

Shrinking reactors isn’t small thinking; it’s a crucial step in making nuclear power a reality. After decades of slow growth and costly overruns in nuclear, a new wave of startups is betting on smaller, modular reactors to make nuclear power more scalable. In the final weeks of 2025, nuclear startups raised $1.1 billion, fueled by optimism that smaller reactors, built with mass-manufacturing techniques, can avoid the delays and cost overruns of massive plants like Vogtle 3 and 4. However, scaling nuclear isn’t just about money: U.S. manufacturers face a shortage of skilled labor and gaps in domestic supply chains for specialized materials. Experts stress that while modular designs could accelerate learning and efficiency, meaningful cost reductions will take years. Regardless, nuclear reactors might be half the size of their former selves, but they’re still sparking full investor excitement.

Robo-renaissance

NEO one expected this from humanoid robots, especially not so soon. Startup 1X unveiled its World Model, a video-based AI system that allows its NEO humanoid robot to teach itself entirely new physical skills. The World Model learns from internet-scale video and then grounds its insights in real-world physics. The idea is that with the new model, NEO can turn simple text or voice prompts into actions, even in situations it’s never encountered before. This approach closes a longstanding gap in robotics, especially for humanoids: transferring digital intelligence into physical behavior without relying on human training. The World Model represents the first scalable architecture for autonomous skill acquisition, unlocking faster, cheaper, and more adaptable humanoid robots for consumer and industrial markets alike. I know Darwin wouldn’t agree, but this sounds a lot like spontaneous evolution to me.

Market Stirrings 🚩

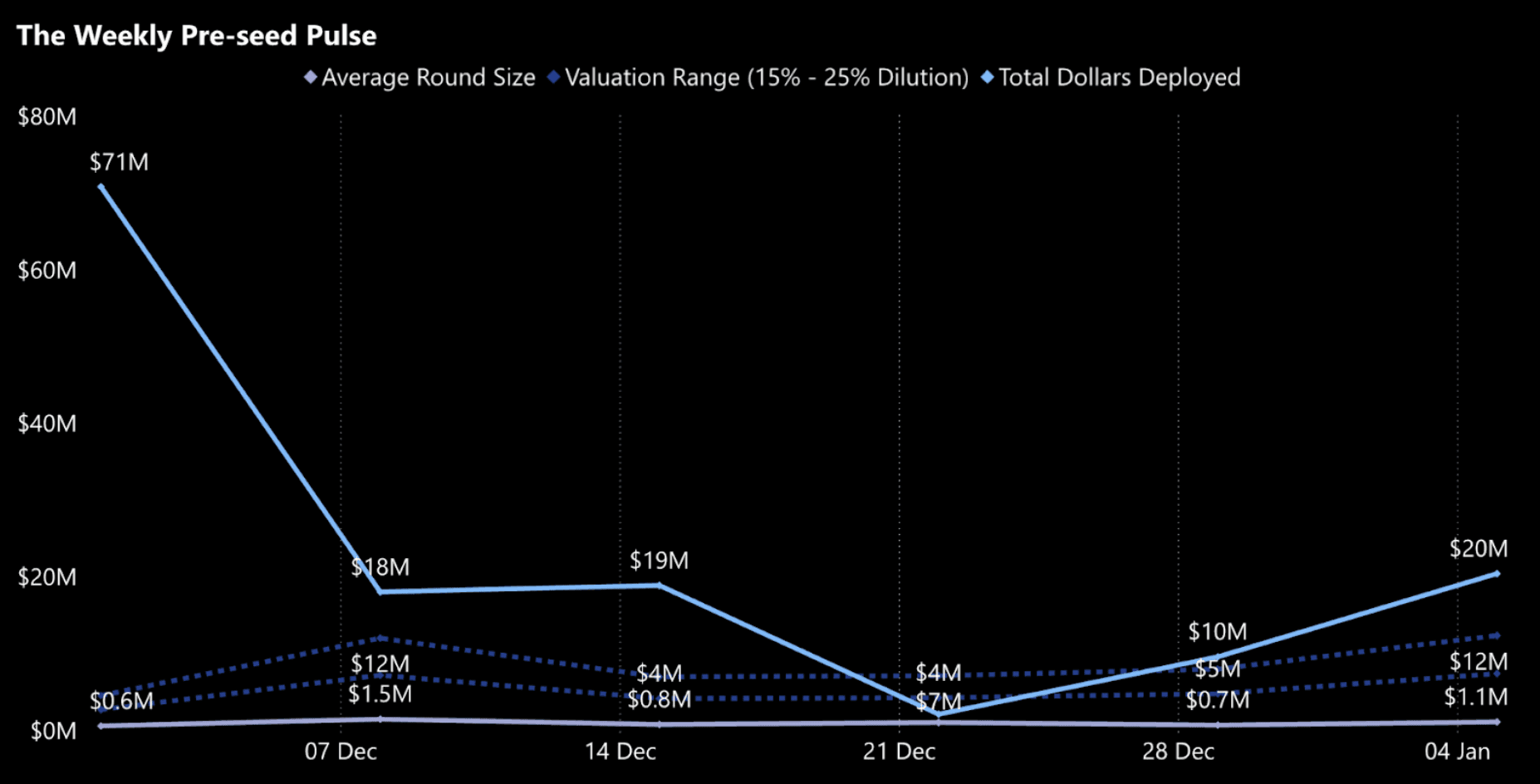

Here's what the week looked like in pre-seed:

$20.5M

18

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

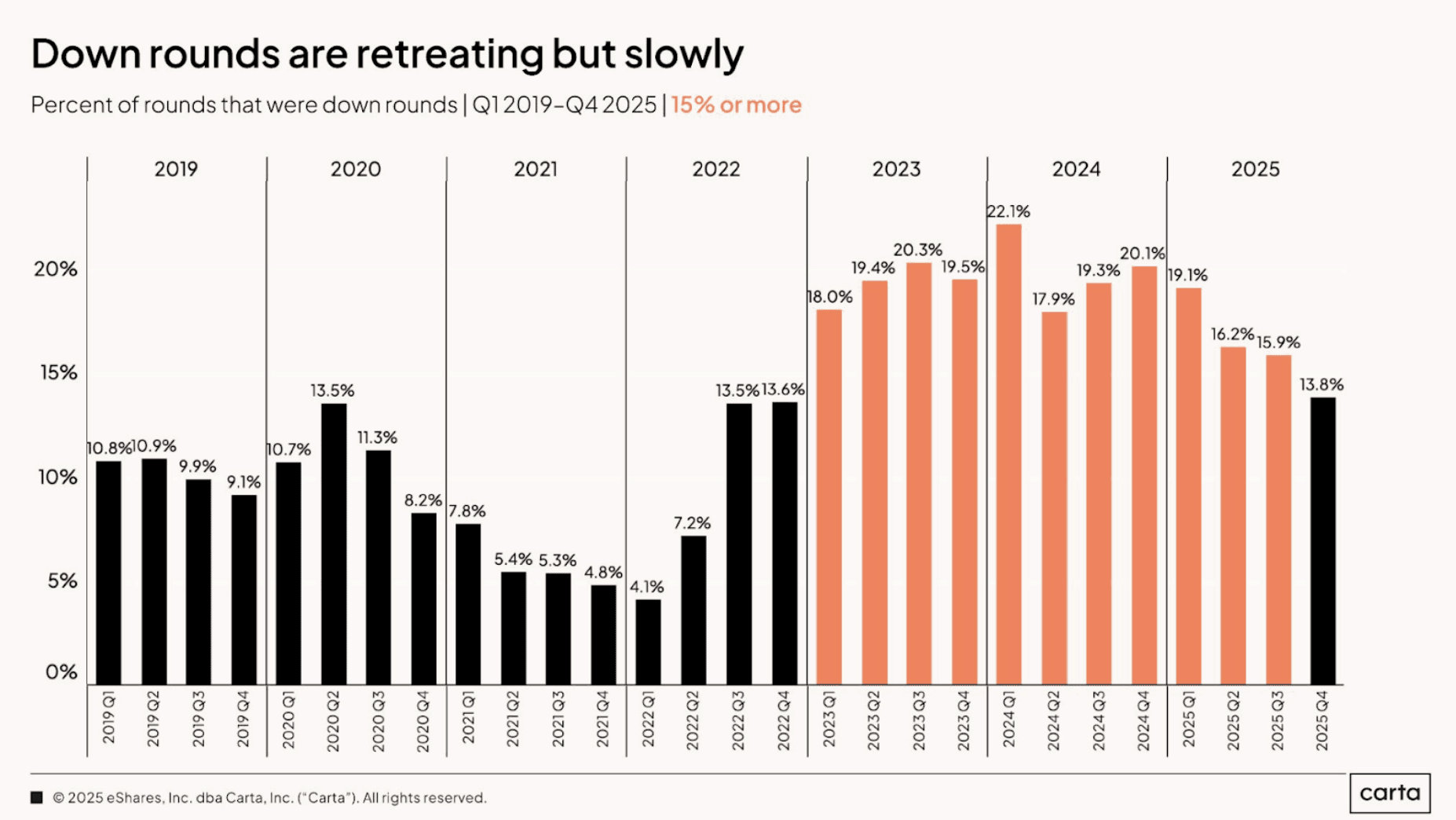

DON'T LOOK SO DOWN

The share of down rounds is falling, down 13% quarter over quarter and 31% year over year. After peaking at more than 22% of all rounds, the era of frequent down rounds appears to be behind us, and the trend is, well, down.

healthtech

Xella Health - On a date-a, don't text.

Xella Health raised $3.7 million led by Precursor Ventures. Xella Health is building a women’s precision health platform that combines multi-omic diagnostics, longitudinal data, and clinician-led, AI-supported guidance.

AI

Chamber - Flustered by the cluster.

Chamber raised $500k from Y Combinator. Chamber is creating an AI infrastructure platform that optimizes GPU workloads, letting teams run more AI jobs on the same hardware.

AI

Autonomous Technologies Group - Healthy, wealthy and AI.

Autonomous Technologies Group raised $15 million led by BoxGroup and Y Combinator. Autonomous Technologies Group is building Autonomous, an AI financial advisor that blends robo-advising with wealth management.

JOBORTUNITIES

| VP of Finance | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation.

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!