Is that a star? No Mom, it's a data center.

Jan 23, 2026

Kaley Ubellacker

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

What's happening at Necessary Ventures:

Copper is launching a pilot program with the New York City Housing Authority, installing 100 of its induction stoves in residential units to replace aging gas lines ahead of a rollout of 10,000 stoves.

Forage is partnering with Ayden, one of the largest global payments platform, to enable SNAP EBT payments for Adyen merchants.

For Emerging GPs:

Catalyze opened applications for its 2026 Catalyze Fellowship Fund. The six-month program welcomes 5-10 first-time GPs across private markets, offering them 1:1 operational support and access to a network of experts, mentors, and LPs.

Good Reads 📖

For the rushed reader …

Thinking Machines Lab is losing two co-founders, including CTO Barret Zoph, plus another senior hire, all heading back to OpenAI less than a year after the startup’s launch.

Companies like SpaceX and OpenAI are exploring data centers in space to handle AI’s rising energy demands, using satellites powered by sunlight and laser links instead of Earth’s grids and fiber cables.

Venture-backed defense tech startups aren’t stumbling over fundraising or novel tech, but rather what PitchBook is calling the “Valley of Production.”

For the less rushed reader …

A wandering AI

Thinking Machines Lab is now missing a couple parts. Thinking Machines Lab is losing two co-founders, including CTO Barret Zoph, plus another senior hire, all heading back to OpenAI less than a year after the startup’s launch. Founded by former OpenAI CTO Mira Murati, Thinking Labs is building next-gen AI systems focused on autonomous reasoning and large-scale model innovation. These early exits, reportedly not amicable, highlight the challenges of keeping a high-profile team aligned, even with a $2 billion seed at a $12 billion valuation. Murati has brought in Soumith Chintala, PyTorch creator and AI research heavyweight, as the new CTO. Regardless, the episode is a reminder that even headline-grabbing funding can’t insulate a startup from cultural fractures and retention battles. Seed money can still experience lost roots.

New heights for AI

The next frontier for AI might literally be above us. Companies like SpaceX and OpenAI are exploring data centers in space to handle AI’s rising energy demands, using satellites powered by sunlight and laser links instead of Earth’s grids and fiber cables. The reality is that the power grids are already maxed out, and cooling and maintaining ever-larger data centers is becoming politically and technically difficult. Orbiting data centers could bypass all of that. However, the engineering challenges are brutal: chips overheat in a vacuum, satellites need robotic maintenance, and upgrades aren’t as simple as swapping hardware. If it works, though, the implications are massive. Whoever masters off-planet AI infrastructure could control the fastest, most scalable compute on Earth, potentially defining the winners in the AI arms race for decades. An Interstellar sequel might star ChatGPT instead of Matthew McConaughey.

A not-so-fun factory

In defense, it turns out the bottleneck is more of a bolt-leneck. Venture-backed defense tech startups aren’t stumbling over fundraising or novel tech, but rather what PitchBook is calling the “Valley of Production,” where manufacturing throughput, supply chains, labor, and compliance dictate whether systems ever make it to the field. Investors are following suit, pouring billions into production infrastructure rather than just software or prototypes. Funding for manufacturing-intensive sectors like drones, space systems, and defense electronics surged from $500 million in 2022 to nearly $5 billion in 2025. Startups are compressing funding cycles to build factories early, and the DoD is prioritizing delivery credibility over pure technology novelty. The companies that master repeatable production have the advantage in capturing capital and contracts at scale. This is certainly not the kind of valley San Francisco dwellers hope for.

Market Stirrings 🚩

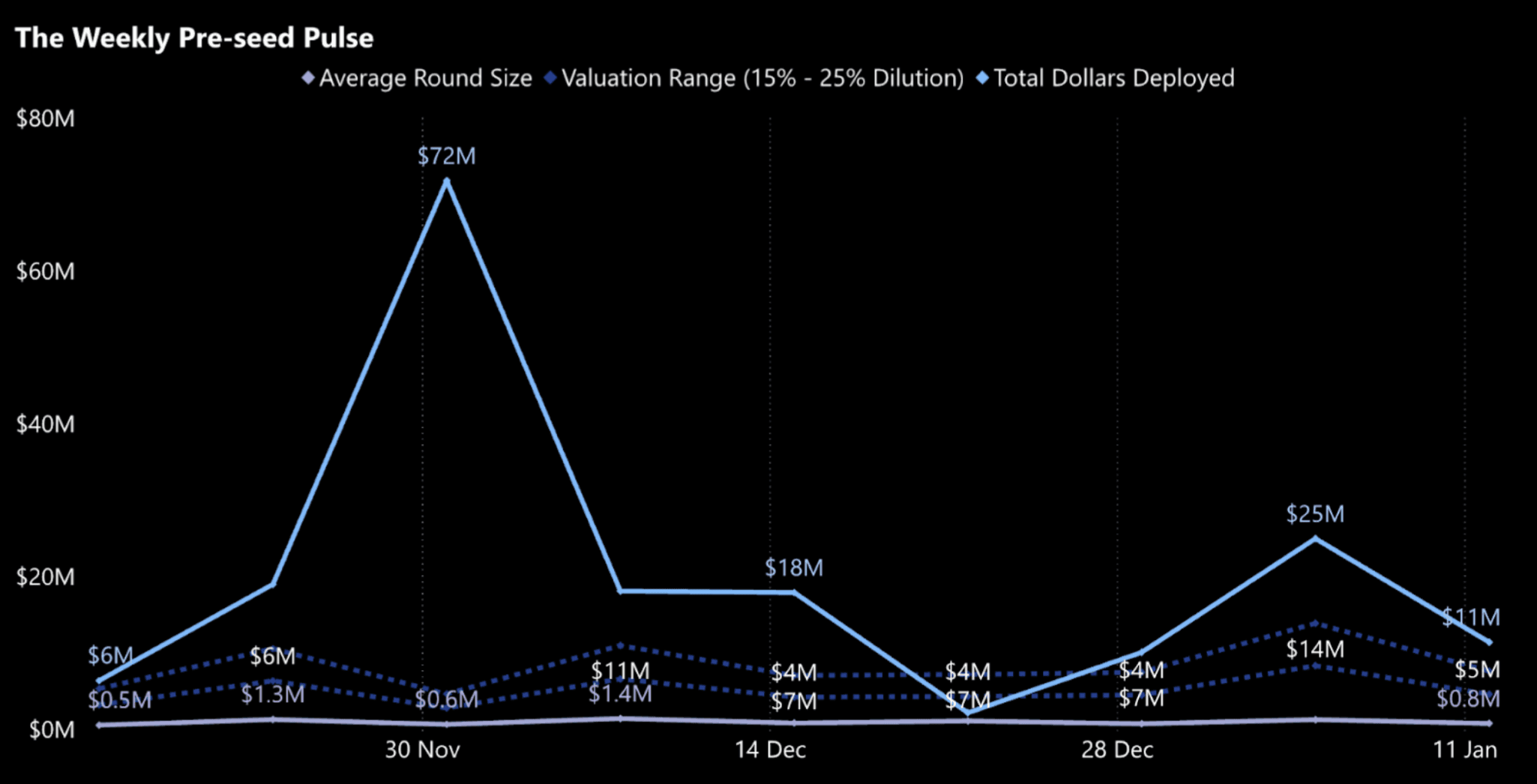

Here's what the week looked like in pre-seed:

$11.4M

15

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

THE DILUTION REVOLUTION

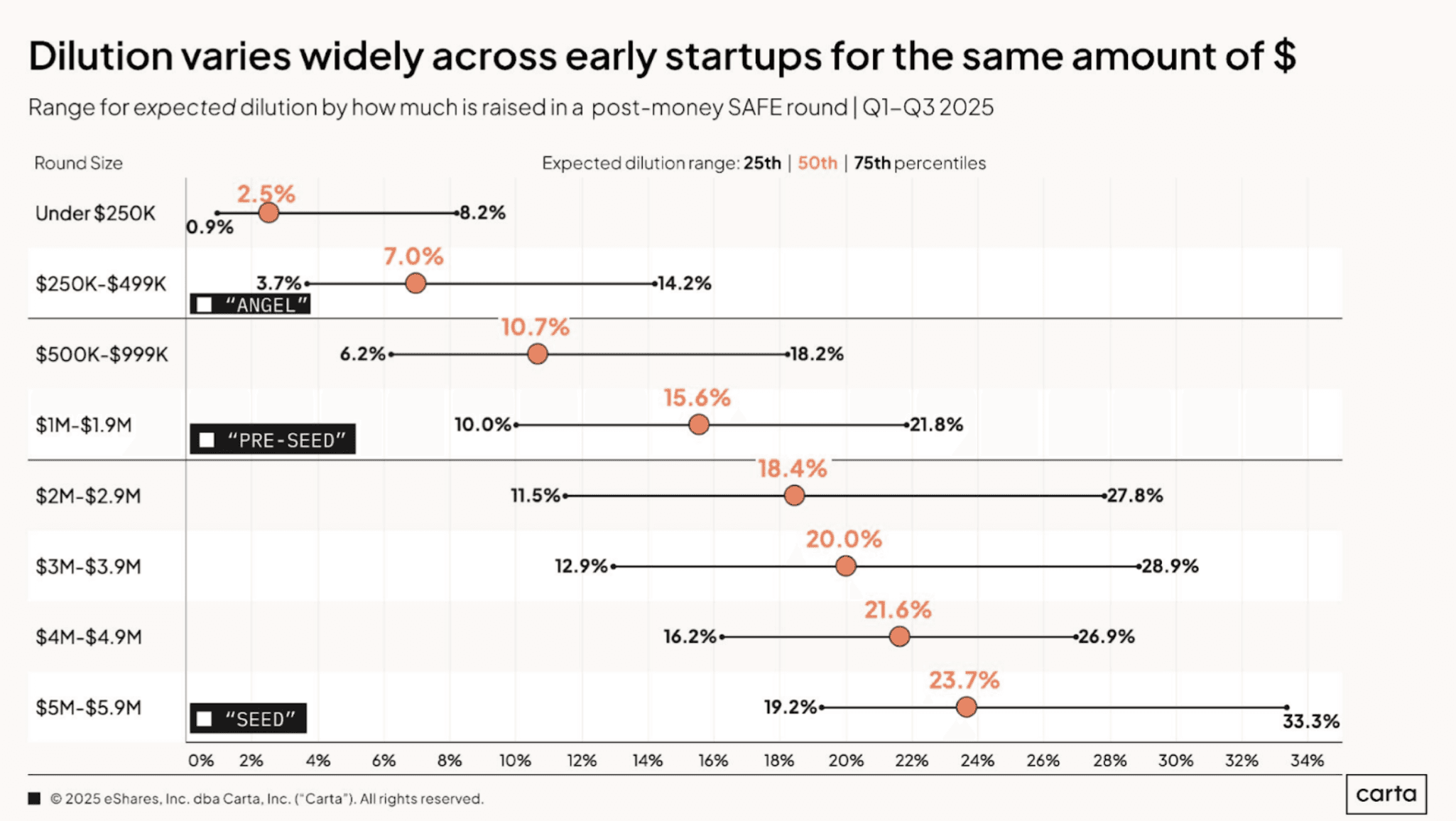

For early-stage startups, median dilution ranges widely, from 2.5% for rounds under $250k to 23.7% for rounds around $5 to 5.9 million, and generally increases with the size of the raise. Pre-seed rounds between $500k and $999k show some of the highest variability, with dilution ranging from 6.2% to 18.2%.

fintech

RouteSense - Payments that make cents.

RouteSense raised $2 million led by Redbud VC. RouteSense is developing a predictive intelligence platform to help payments teams spot problems early and automatically route transactions to the healthiest accounts.

SaaS

Corvera - Shelf confidence.

Corvera raised $2 million led by Firstminute Capital and Y Combinator. Corvera is building an AI-powered, hands-free command center for CPG brands that automates supply chains.

AI

Meet Caria - Higher level hiring.

Meet Caria raised $1 million from ANF Investment at a $2 million pre-money valuation. Meet Caria is creating an AI recruiting platform that sits on top of existing systems to automate end-to-end hiring workflows for large enterprises.

JOBORTUNITIES

| VP of Finance | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!