Venture is in its comeback era. 📈

Jan 8, 2026

Kaley Ubellacker

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

What's happening at Necessary Ventures:

Portfolio company Magrathea signed an Offtake Distribution Partnership with global metals trader Wogen, including a $10 million working capital commitment.

Worth checking out for Emerging GPs:

Catalyze opened applications for its 2026 Catalyze Fellowship Fund. The six-month program welcomes 5-10 first-time GPs across private markets, offering them 1:1 operational support and access to a network of experts, mentors, and LPs.

Good Reads 📖

For the rushed reader …

A new TechCrunch piece looks at why dropping out has become a fashionable founder signal again, despite studies showing most successful startups are built by founders with degrees.

After three flat years, global venture funding roared back in 2025, with capital, deal sizes, and valuations all hitting record territory, according to Crunchbase.

Commonwealth Fusion Systems is betting AI can compress timelines for fusion, the same way it did for chips and code.

For the less rushed reader …

The third degree

Dropping out of college doesn’t mean dropping out of the VC talent pool. A new TechCrunch piece looks at why dropping out has become a fashionable founder signal again, despite studies showing most successful startups are built by founders with degrees. The urgency of the current AI cycle, amplified by YC Demo Days and high-profile young founders, is pushing some students to frame leaving school as proof of conviction or speed. Investors quoted in the article suggest the reality is more nuanced: many VCs care far less about whether a founder finished their degree than about what they’ve built, learned, and shipped, particularly for students close to graduating. Others point out that universities still provide value through networks and brand, diploma or not, and some investors are wary that very young founders may lack the experience and scar tissue needed to navigate company-building. The hottest major of 2026 might be undeclared, but students should think twice before skipping class.

Venture's comeback tour

No lawyer needed: venture capital raised the bar in 2025. After three flat years, global venture funding roared back in 2025, with capital, deal sizes, and valuations all hitting record territory, according to Crunchbase. Investors poured $425 billion into startups, up 30% year over year, making 2025 the third-biggest venture year ever. Investments were less driven by broad-based recovery as they were extreme concentration at the top. AI dominated roughly half of all global venture dollars, with just five mega-round recipients (including OpenAI, Anthropic, and xAI) accounting for 20% of all funding. Valuations ballooned, pushing the global unicorn tally toward $7.5 trillion. The U.S. reclaimed market share with capital flowing into large, late-stage AI companies, and early-stage funding rebounded. To summarize in a few key points: companies raised more money, M&A hit record levels, the IPO window cracked open, and liquidity finally re-entered the chat.

Ion-credible progress

Fusion isn’t just splitting atoms; it’s splitting timelines too. Commonwealth Fusion Systems is betting AI can compress timelines for fusion, the same way it did for chips and code. In a CES announcement alongside Nvidia and Siemens, the fusion startup said it’s building a digital twin of its demonstration reactor, using Nvidia’s AI platform and Siemens’ industrial data to simulate and optimize experiments that would normally require years of physical testing. CFS says this approach could shrink years of manual iteration into weeks of virtual experimentation, pushing toward its goals of net energy generation by 2027 and commercial fusion in the early 2030s. While the company hasn’t quantified exact time savings, the move offers a concrete example of AI shifting from productivity gains to scientific acceleration. AI is opening the door for startups tackling problems that VCs historically avoided because timelines were too long or capital intensity too high. It’s a new-clear game now.

Market Stirrings 🚩

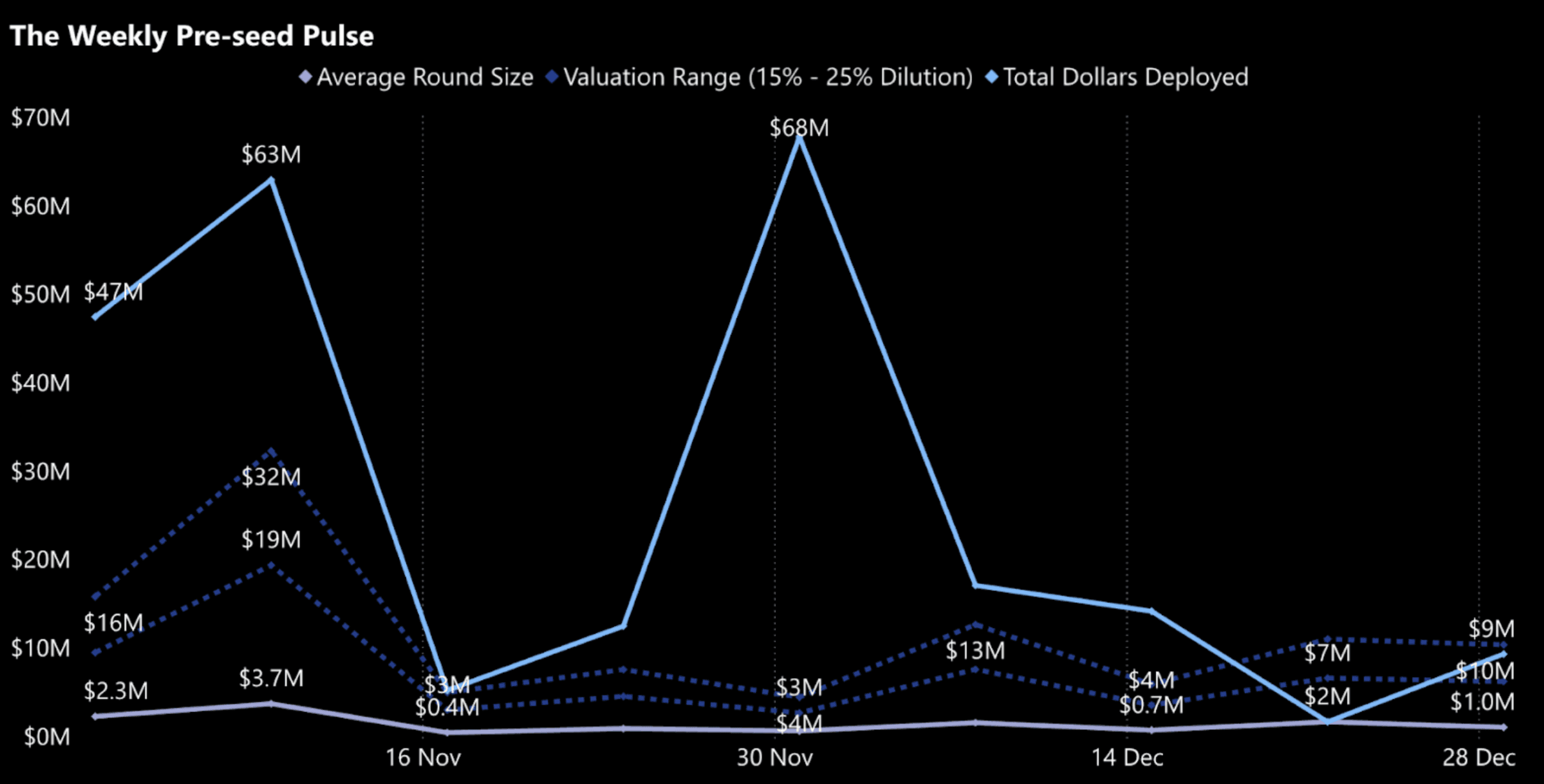

Here's what the week looked like in pre-seed:

$9.3M

9

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

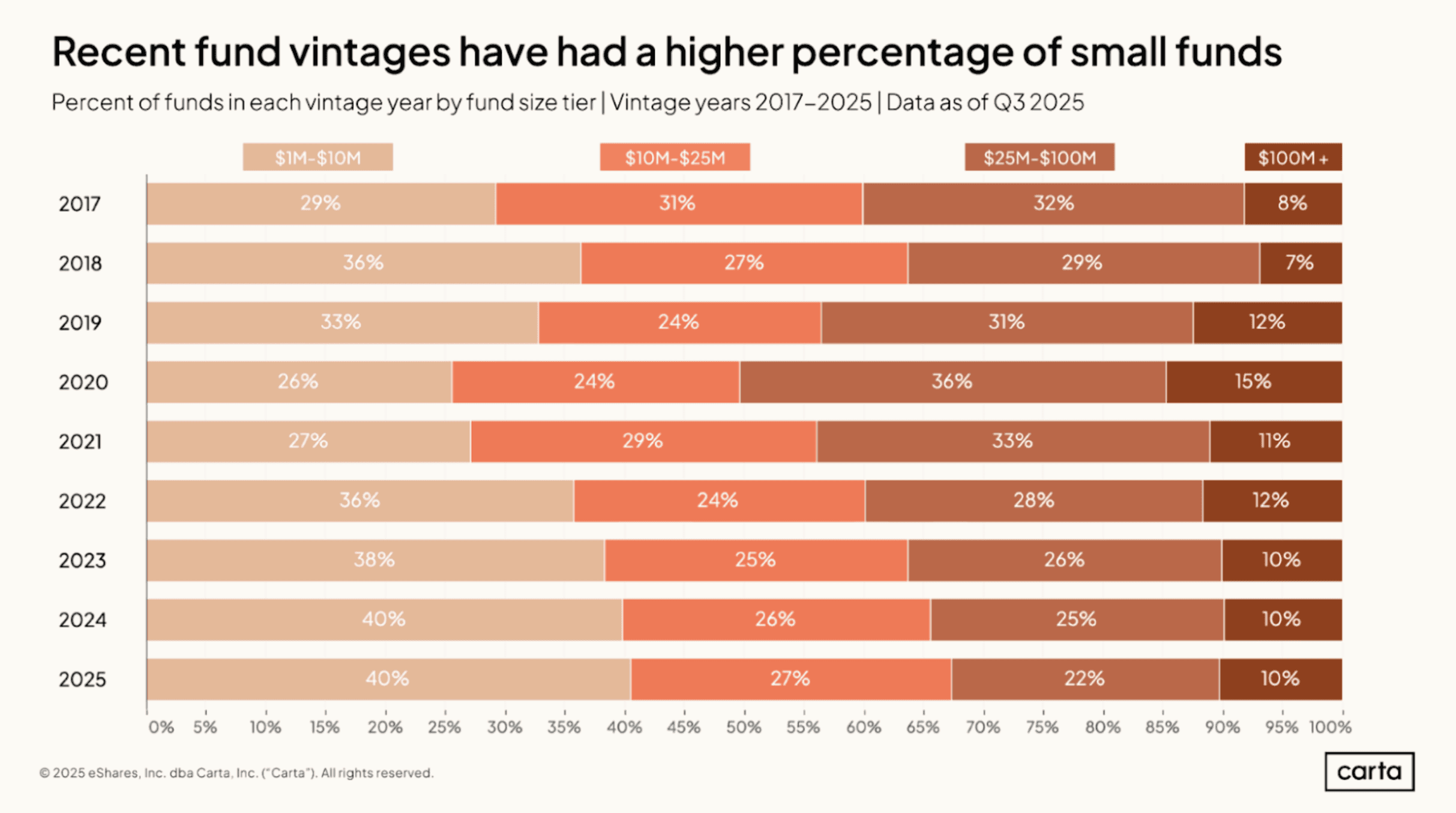

VC FUNDS ARE SHRINKING

Capital is concentrating at the small end of the market, with sub $25 million funds up 12% since 2022 and $25 to $100 million funds down 12% year over year. The shift reflects LP caution, tougher fundraising conditions, and growing momentum behind smaller, emerging managers.

saas

Hardline - Less typing, more talking.

Hardline raised $2 million including participation from Alumni Ventures, AngelList, and StandUp Ventures. Hardline is creating a platform that turns everyday jobsite phone calls into automatic, real-time construction documentation.

AI

VisaPal - Green cards without the red tape.

VisaPal raised $2 million at a $10 million pre-money valuation. VisaPal is building an AI immigration platform that replaces costly legal guesswork with automated filings and real-time support..

AI

Zendly - Funnel vision.

Zendly raised $200k. Zendly is developing a tool to replace static funnels with AI agents that onboard and activate users through natural, conversational experiences.

JOBORTUNITIES

| VP of Finance | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation.

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!