Why factories should think inside the box 🧰

Oct 1, 2025

Kaley Ubellacker

Happy Wednesday!

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

Good Reads 📖

For the rushed reader …

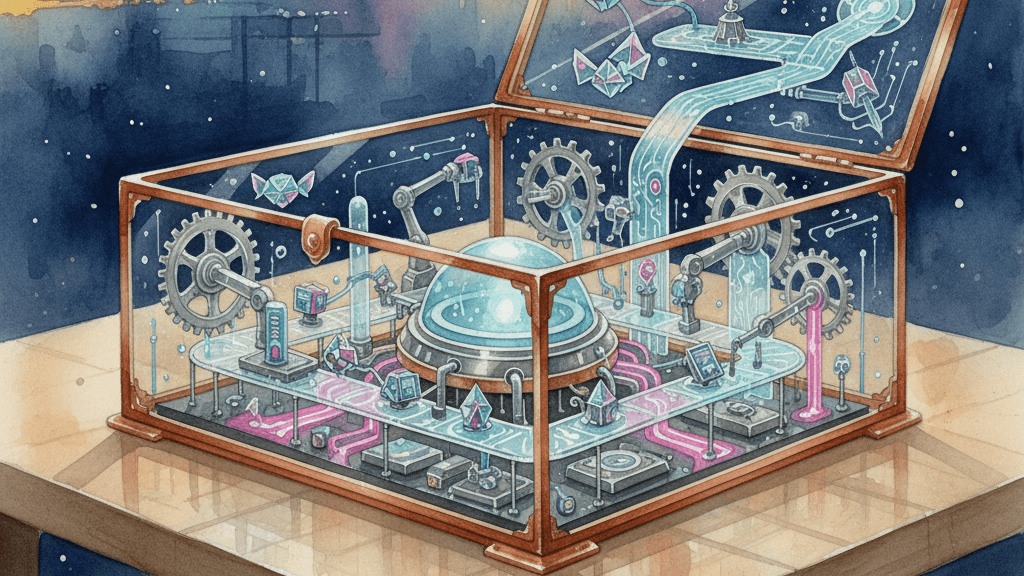

MicroFactory is building a tabletop factory-in-a-box complete with two robotic arms that can be trained via human demonstration or AI.

ARR (annual recurring revenue) is being reported at unprecedented rates, but the metric is increasingly inconsistent.

According to Crunchbase, in 2025, U.S. biotech startups have captured the lowest share in more than 20 years in seed-to-growth funding, while overall venture investment climbs.

For the less rushed reader …

Small box, big brains

A San Francisco startup is thinking small to make a big impact. MicroFactory is building a tabletop factory-in-a-box complete with two robotic arms that can be trained via human demonstration or AI. Maybe humanoid robots aren’t all that. MicroFactory’s compact system focuses on precision tasks like circuit board assembly, soldering, and cable routing, where users guide the arms through complex motions for faster training. Co-founders Igor Kulakov and Viktor Petrenko, veterans of hands-on manufacturing, launched the startup in 2024 and completed a prototype in just five months. Today, they’ve amassed hundreds of preorders for applications as varied as electronics assembly and escargot processing. With $1.5 million in pre-seed funding led by Hugging Face execs and Naval Ravikant, MicroFactory is gearing up to ship commercial units in the next two months and scale production to 1,000 robots in its first year. It doesn’t take an arm and a leg anymore; just two arms will do.

ARR you sure?

Building a startup has always required creativity, but now there’s also the ARR-t of inflating numbers. ARR (annual recurring revenue) is being reported at unprecedented rates, but the metric is increasingly inconsistent. Midjourney’s ARR rose from zero to $200 million in under three years; ElevenLabs reached nearly $100 million in 20 months; Lovable hit $100 million in three months; and Cursor scaled to $100 million in a year. Founders are increasingly counting pilots, short-term deals, or unactivated contracts as recurring revenue. Traditional SaaS-era conventions for calculating ARR are often absent in AI startups, where usage, token consumption, and pilot programs drive revenue. Investors note that some ARR claims are based on projected payments or contracts with kill provisions, where customers can cancel at any time. With over 3,000 VC firms managing more than $360 billion today, the rapid influx of capital into early-stage AI companies has amplified pressure on founders to report large ARR figures, even when actual revenue is uncertain. Call it ARR-magedon, the majestic battle between numbers and dollars.

Time to say good-bio?

Biotech’s share is shrinking, and it’s no small matter. According to Crunchbase, in 2025, U.S. biotech startups have captured the lowest share in more than 20 years in seed-to-growth funding, while overall venture investment climbs. To put a number on it, biotech raked in just $16.6 billion so far in 2025, representing roughly 8% of all venture dollars. Early-stage funding is particularly thin, with just $8.2 billion raised, signaling a shrinking pipeline of future scale-ups. However, there were a few mega rounds, like Kardigan’s $300M seed and Lila Sciences’ $235M Series A. Biotech IPOs are also in retreat, with only 18 debuts so far this year. The shift isn’t only about waning enthusiasm: AI startups are pulling in massive capital, with North American AI deals reaching nearly $90 billion in H1 alone, including OpenAI’s $40 billion SoftBank-led round. This is probably something people who wear lab coats are used to, but it looks like biotech got benched.

Market Stirrings 🚩

Here's what the week looked like in pre-seed:

$10.5M

14

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

TAKING A BIGGER SL(AI)CE

AI continues to take a larger share of pre-seed venture funding, rising 11% year-over-year in September as a percentage of total investment. In contrast, fintech and health tech have seen their share shrink dramatically over the same period, dropping 66% and 44% respectively.

SaaS

Seattle Ultrasonics - Cutting edge tech.

Seattle Ultrasonics raised $2 million. Seattle Ultrasonics is building the first-ever ultrasonic chef’s knife that vibrates 40,000 times per second to slice through food with less force.

AI

MicroFactory - Thinking inside the box.

MicroFactory raised $1.5 million with participation from Clément Delangue, founder of Hugging Face, and Naval Ravikant, early backer of Uber and Twitter, at a $28.5 million pre-money valuation. MicroFactory is building a robot-in-a-box that learns by demonstration, tackling tasks from soldering to food prep.

AI

Ardent AI - From spaghetti code to gourmet pipelines.

Ardent AI raised $2.15 million led by Crane Venture Partners. Ardent AI is building the world’s first autonomous AI Data Engineer, capable of creating and managing complex data pipelines.

JOBORTUNITIES

| Hardware Test Engineer | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation.

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!