ARR you in the loop?

Feb 12, 2026

Kaley Ubellacker

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

What's happening at Necessary Ventures:

Happenings at Necessary Ventures:

Pathos is hiring an AI research engineer to design and innovate on the AI brains that power Pathos’ AI therapist.

For Emerging GPs:

Catalyze opened applications for its 2026 Catalyze Fellowship Fund, due February 14. The six-month program welcomes 5-10 first-time GPs across private markets, offering them 1:1 operational support and access to a network of experts, mentors, and LPs.

Good Reads 📖

For the rushed reader …

For the rushed reader:

A new PitchBook report is urging founders and investors not to get carried away by the recent IPO headlines.

The AI gold rush created a new obsession in Silicon Valley: startups sprinting from $0 to $100 million in ARR, sometimes before even raising a Series A.

Former GitHub CEO Thomas Dohmke is launching Entire, an already $300M-valued startup aimed at developers in an era where AI agents do most of the coding

For the less rushed reader …

Public knowledge

The IPO market is back, but it’s more of a limited series. A new PitchBook report is urging founders and investors not to get carried away by the recent IPO headlines. While 2025 saw a rebound in U.S. public listings, like the high-profile debuts from Figma, Klarna, and CoreWeave, only 48 companies went public. That number stayed roughly in line with other post-pandemic years. Moreover, fewer than 20 companies reached unicorn status. Much of the activity was concentrated in fintech, defense tech, AI, and crypto, leaving a large backlog of venture capital still locked in private markets. PitchBook’s analysts make the argument in the report that the market is only partially open, and founders and investors alike should expect a gradual recovery in 2026, not a surge of listings. According to PitchBook, even anticipated blockbuster IPOs could strain investor appetite. In 2026, IPO is more aptly pronounced I-P-woah Nelly, slow down!

ARR you serious?

Here’s a summertime growth spurt that’s making all the founders jealous. The AI gold rush created a new obsession in Silicon Valley: startups sprinting from $0 to $100 million in ARR, sometimes before even raising a Series A. TechCrunch released an interview with Andreessen Horowitz GP Jennifer Li, and she’s warning founders not to confuse ARR hype with health. Li noted that many viral ARR claims are actually revenue run rates, a far less durable metric than contracted recurring revenue. Explosive growth can mask weak retention, short-term pilots, or one-off spikes. The pressure to match headline-grabbing numbers is creating unnecessary anxiety for founders. Instead of optimizing purely for top-line speed, she argues startups should focus on sustainable growth, strong retention, and operational discipline. While hypergrowth is possible, it comes with hiring challenges, customer backlash risks, and compliance headaches. The ARR debacle is about more than revenue runway; it’s revenue runaway.

Entire-ly automated

The former GitHub CEO is committed to a new chapter. Former GitHub CEO Thomas Dohmke is launching Entire, an already $300M-valued startup aimed at developers in an era where AI agents do most of the coding. Entire’s first product, Checkpoints, captures the context behind AI-written code, including prompts, reasoning, and decisions, so developers can understand and manage what agents produce. Dohmke emphasizes that Entire isn’t building AI agents itself, but creating an open, scalable platform that integrates with any coding AI, offering a home for agent-generated code. The startup is on a mission to rethink software development completely, treating AI coding like an assembly line while keeping human oversight efficient and organized. Software development is officially getting a reboot.

Market Stirrings 🚩

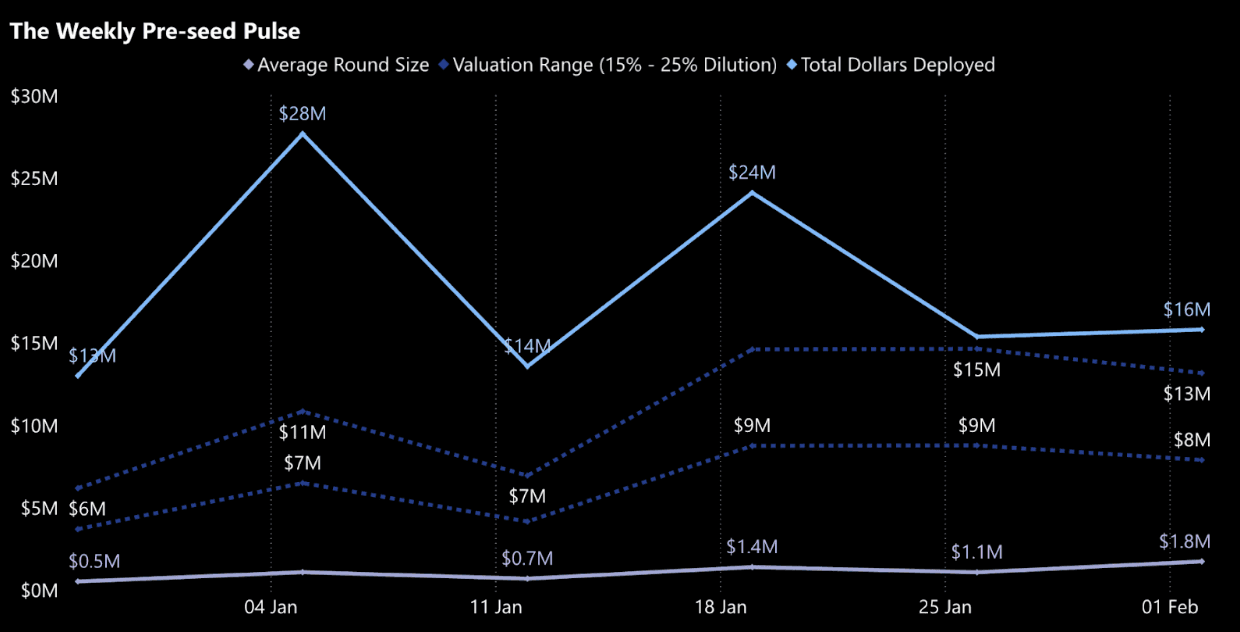

Here's what the week looked like in pre-seed:

$15.8M

9

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

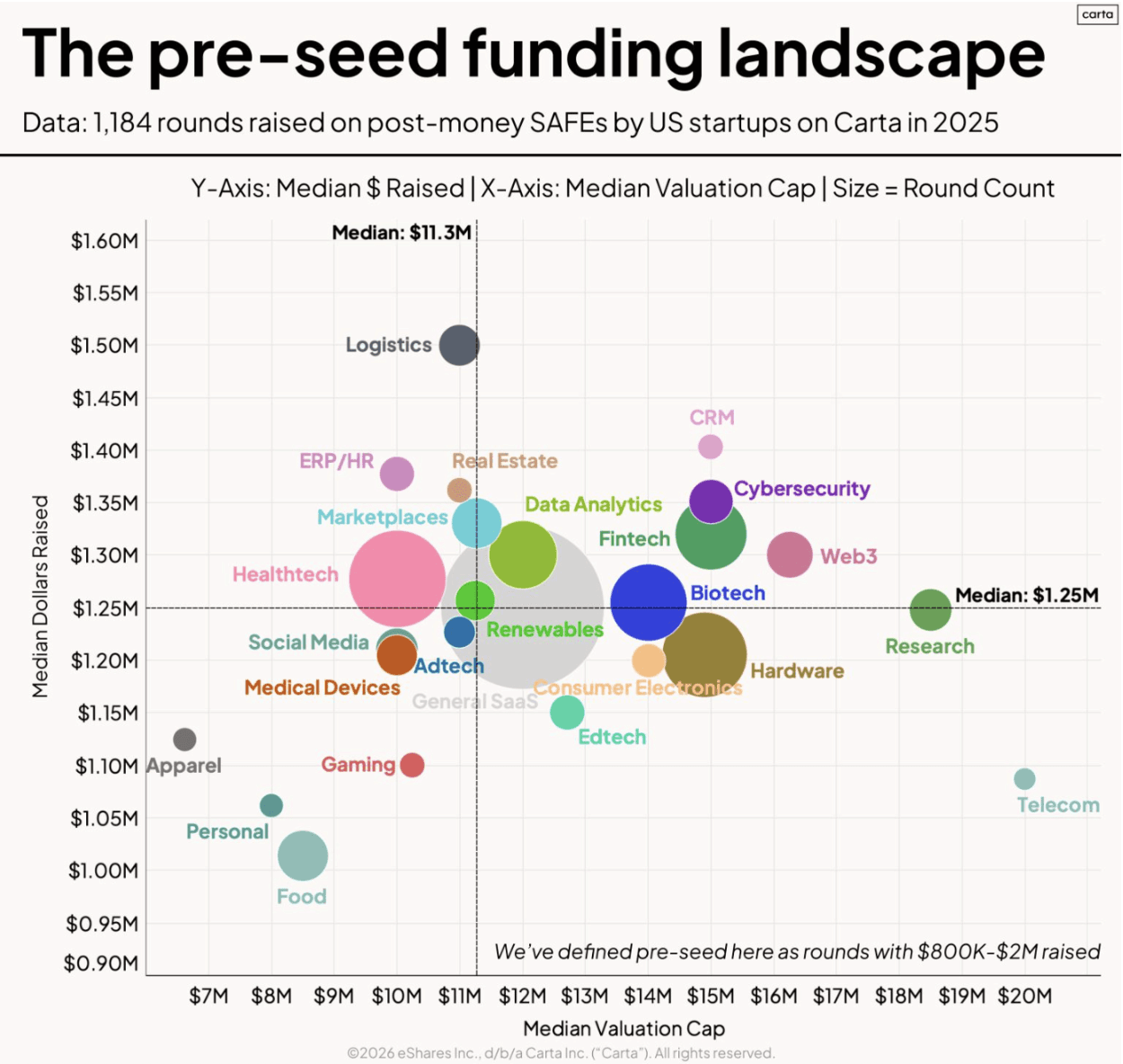

THE LAY OF THE PRE-SEED LAND

In 2025, the median pre-seed raise on Carta was $1.25 million, with a median valuation of $11.3 million. Research startups hit a sweet spot, raising similar capital ($1.25M) but at higher valuations, with a median cap approaching $19 million.

climatetech

Supra Elemental Recovery - A rare opportunity.

Supra Elemental Recovery raised $2 million led by Crucible Capital. Supra is building a non-toxic refining platform that extracts critical minerals like gallium and scandium from industrial waste.

SaaS

Breezy - It's all about automation, automation, automation.

Breezy raised $10 million from Ribbit Capital. Breezy is creating an AI operating system for residential real estate agents to automate workstreams from start to finish.

AI

BizTrip AI - AI-rplane mode.

BizTrip AI raised $1.5 million led by RRE Ventures. BizTrip AI is developing an agentic AI travel platform that automates and optimizes corporate travel planning.

JOBORTUNITIES

| VP of Finance | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation.

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!