OpenClaw and Order: AI agents are talking to each other

Feb 5, 2026

Kaley Ubellacker

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

What's happening at Necessary Ventures:

Rubi Laboratories spoke at the World Economic Forum's annual meeting in Davos, Switzerland.

Akido Labs is piloting Scope AI next month in the Bay Area in partnership with Five Keys, ReImagine Freedom, and the Future Communities Institute to help street medicine teams assess and treat homeless patients.

Plural is hiring a top-tier finance pro to lead deals, build models, and help launch the next generation of public-private infrastructure.

For Emerging GPs:

Catalyze opened applications for its 2026 Catalyze Fellowship Fund. The six-month program welcomes 5-10 first-time GPs across private markets, offering them 1:1 operational support and access to a network of experts, mentors, and LPs.

Good Reads 📖

For the rushed reader …

US venture debt hit another record in 2025, reaching $62.4 billion in deal value, according to PitchBook..

OpenClaw, the viral personal AI assistant, made its headline debut, experiencing rapid growth into a community-powered project with over 100,000 GitHub stars in just two months.

Two years after leaving Google, Fitbit cofounders James Park and Eric Friedman are back with a new bet, fixing health tech’s individualistic approach with a solution for families.

For the less rushed reader …

Putting on a debt-ective hat

The phrase “giving credit where credit is due” is taking on a whole new meaning. US venture debt hit another record in 2025, reaching $62.4 billion in deal value, according to PitchBook. The record high is driven by larger startups seeking bigger checks and the rise of AI-focused companies, even as total deal count fell 19% year-over-year. Following SVB’s collapse in 2023, non-bank lenders initially filled the gap, but traditional banks have now re-entered the market. Marshall Hawks, a former Silicon Valley Bank executive, notes that startups are now asking for $100 million-plus facilities, making them attractive to major private credit firms. High-profile AI deals further illustrate the trend, with Crusoe raising $750 million in venture debt for data centers and xAI securing a $5 billion loan from Morgan Stanley. The combination of larger private companies, extended growth cycles, and AI infrastructure demands is reshaping the venture debt landscape. Some might even call it a debt-volution.

Shelling out on open source

It’s happening: AI agents are finally sharing user horror stories with each other. OpenClaw, the viral personal AI assistant, made its headline debut, experiencing rapid growth into a community-powered project with over 100,000 GitHub stars in just two months. It was founded by Austrian developer Peter Steinberger, who came out of retirement after exiting his previous company PSPDFKit to, direct quote, “mess with AI.” Recently rebranded as Moltbot in hopes of avoiding copyright issues from Anthropic, the platform lets AI assistants run locally on users’ computers and interact through chat apps. One such app that spawned is a social network for AI agents called Moltbook, where they exchange skills and instructions – no humans allowed. OpenClaw is still early-stage and technically complex, but IT teams everywhere are sounding the alarm bell on security risks. Moltbot’s maintainers are expanding the team, improving safeguards, and exploring sponsorship to fund full-time development, with mainstream adoption being the long-term goal. Terminator is definitely the second thing that comes to mind, but why is the first thing how much FOMO I have for not being allowed in Moltbook?

Welcome to the family business

Here’s another step worth counting. Two years after leaving Google, Fitbit cofounders James Park and Eric Friedman are back with a new bet, fixing health tech’s individualistic approach with a solution for families. Park and Friedman are self-funding Luffu, a new startup on a mission to create an AI-powered family care system that compiles fragmented health data across people, devices, calendars, and portals. The platform will automatically surface any meaningful changes, missed meds, unusual vitals, shifting routines, before they turn into emergencies. Their pitch focuses on activating background intelligence to reduce the mental load of caregiving, especially for the growing number of adults juggling kids, careers, and aging parents. It’s still in private testing, but Luffu already shows the sign of an easy success story for veteran founders. We already have Fitbit; now, it’s time for … Familybit?

Market Stirrings 🚩

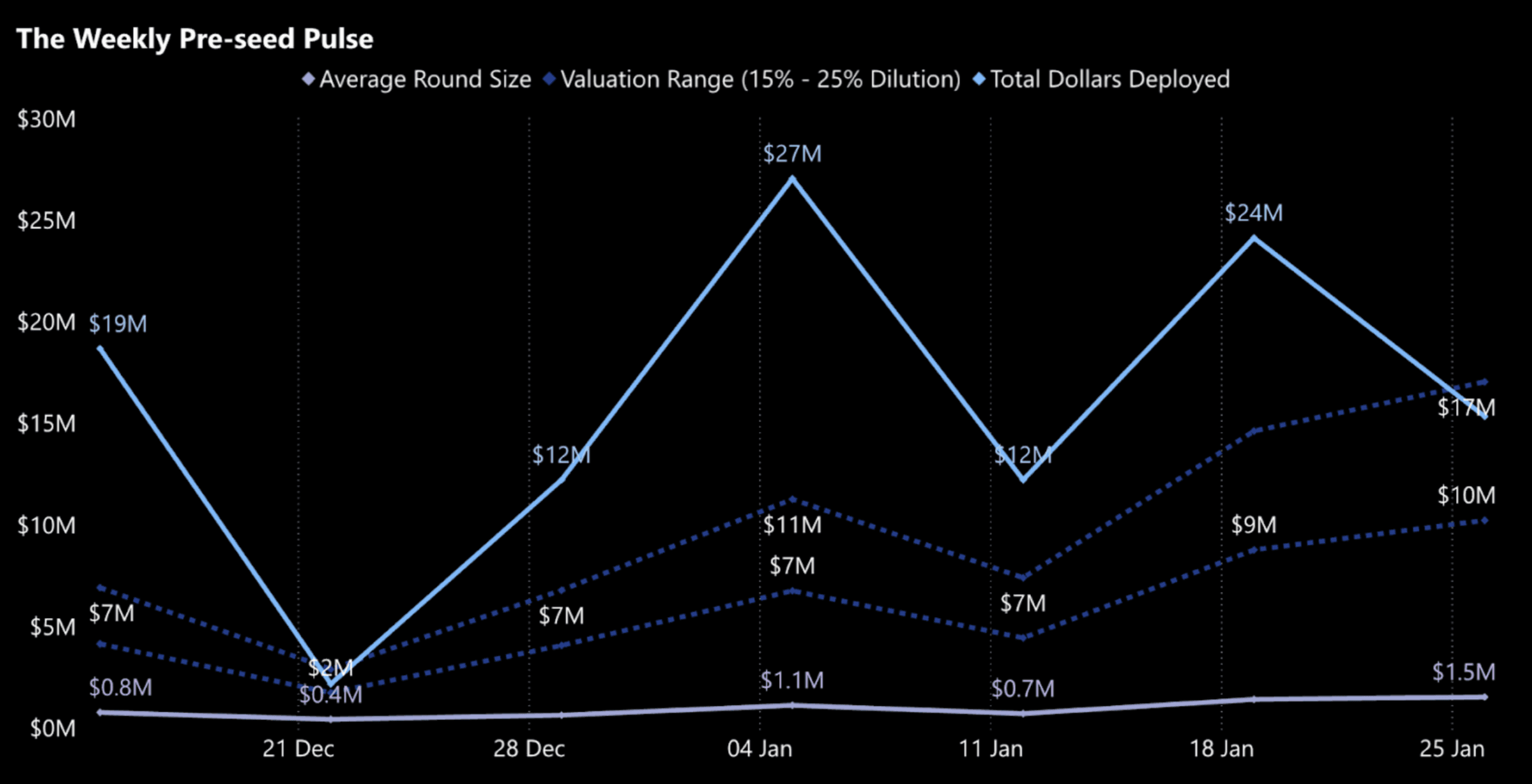

Here's what the week looked like in pre-seed:

$15.4M

10

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

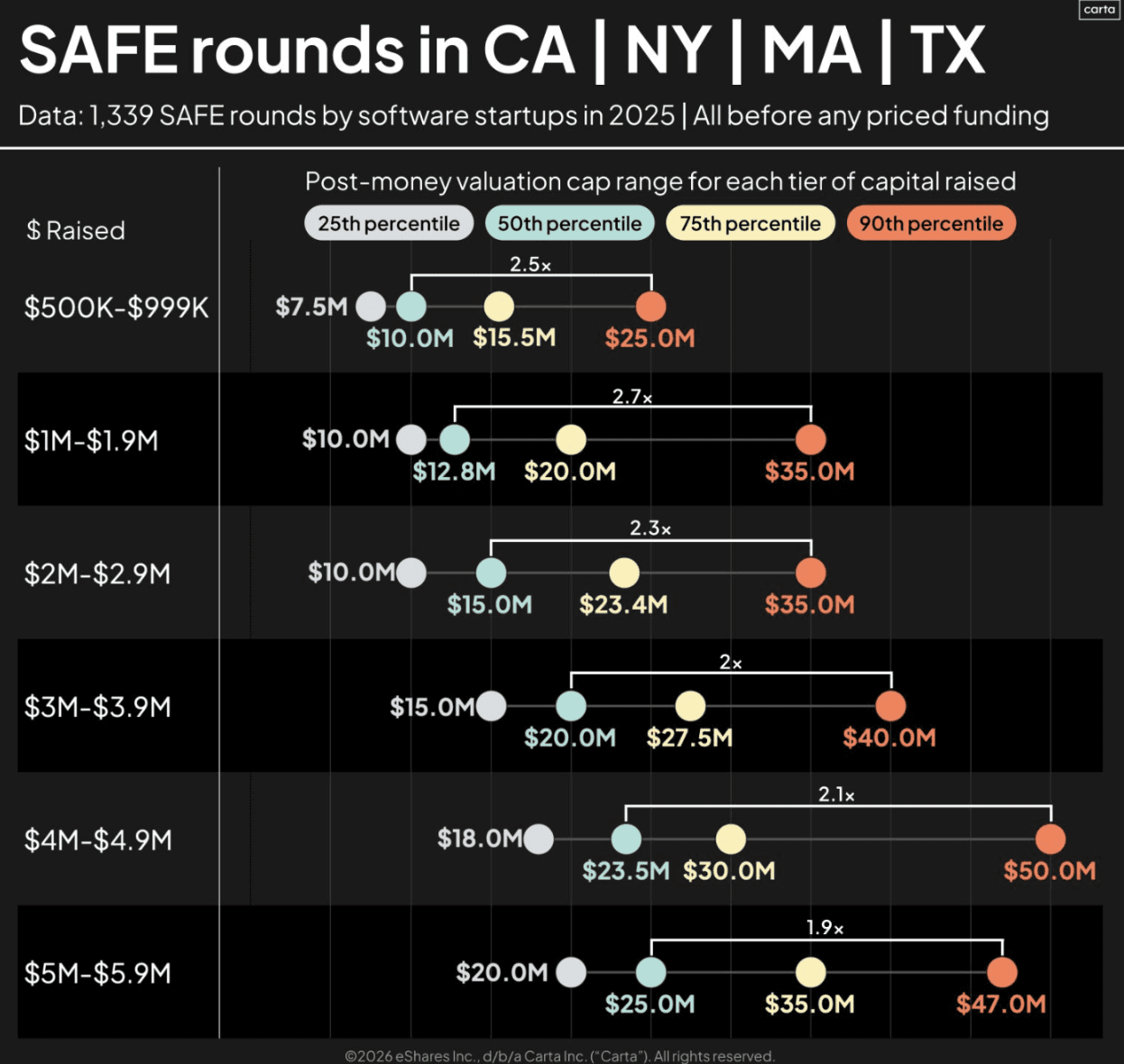

BIGGER IS BETTER

For SAFE rounds, one trend is clear: larger raises correspond to higher post-money valuations. Interestingly, rounds between $4 million and $4.9 million hit a sweet spot, with the 90th percentile of valuation caps topping out at $50 million, the highest across all round sizes.

healthtech

Mos Health - Putting the check in check-up.

Mos Health raised $1.1 million led by Movens Capital and SMOK Ventures. Mos Health is building an AI employee health benefits platform that analyzes personal data to generate wellbeing protocols..

AI

Collective OS - Agency in numbers.

Collective OS raised $2.5 million from Band of Angels, Early Light Ventures, and Team Ignite Ventures. Collective OS is building an AI platform that lets agencies team up, pitch bigger contracts, and operate like full-service firms.

AI

TakeTwo - First movie advantage.

TakeTwo raised funding from Afore Capital and Inovia Capital. TakeTwo is creating an AI film studio that embeds generative AI into filmmaking workflows, making cinematic visuals faster and cheaper.

JOBORTUNITIES

| VP of Finance | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation.

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!