Data centers can't keep their cool 🧊

Dec 4, 2025

Kaley Ubellacker

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

What's happening at Necessary Ventures:

Portfolio company Magrathea signed an agreement to form a joint venture with TETRA Technologies. As part of the agreement, Magrathea will rebuild America’s magnesium metal defense industrial base in Southwest Arkansas.

Nicholas Callegari, founder and CEO of portfolio company Verustruct, was named to the Forbes 30 Under 30 Manufacturing list.

Portfolio company Forage was included on the Inc. Best in Business list in the Best Social Good category.

Good Reads 📖

For the rushed reader …

PitchBook dropped its 2026 VC outlook, forecasting a surge in early-stage deal activity next year, driven by renewed investor confidence, rapid AI company formation, and aggressive seed and Series A investing.

The global surge in AI and cloud computing is creating a critical challenge for data centers: keeping servers cool.

Clipbook, an AI platform that tracks media coverage, just closed a $3 million seed round using a surprising strategy of cold emails.

For the less rushed reader …

The early stage growth spurt

It turns out 2025 showers might bring 2026 flowers. PitchBook dropped its 2026 VC outlook, forecasting a surge in early-stage deal activity next year, driven by renewed investor confidence, rapid AI company formation, and aggressive seed and Series A investing. This prediction follows a notable rebound in 2025: early-stage deal counts climbed for three straight quarters, first financings are on pace just below the 2021 record, and AI is now the main engine of company creation. AI now represents over a third of first financings, and time is shortening between rounds. PitchBook expects these trends to intensify in 2026 as managers deploy more dry powder thanks to improving markups. The report notes that the biggest risk is the ongoing fundraising struggle for emerging managers, but overall it expects early stage to be the strongest-performing segment of VC next year. You know what they say: early to invest and early to advise makes a man healthy, wealthy, and wise.

Data center of attention

Data centers need to chill. The global surge in AI and cloud computing is creating a critical challenge for data centers: keeping servers cool. Recent outages, like the one at CyrusOne that disrupted CME Group’s trading platforms, highlight how traditional air cooling struggles to handle the heat generated by high-powered servers. Operators are turning to liquid cooling, closed-loop water systems, and waste-heat recycling to maintain efficiency, but these solutions bring their own challenges. Despite rare outages, cooling now accounts for up to 40% of data center energy consumption, sparking a wave of industry deal-making, including Eaton’s $9.5 billion acquisition of Boyd Corporation’s thermal business, as companies race to scale infrastructure for AI’s growing energy demands. Things are heating up, and the servers aren’t the only ones sweating.

Pressing forward

When it comes to fundraising, Clipbook made cutting through the noise look easier than ever. Clipbook, an AI platform that tracks media coverage, just closed a $3 million seed round using a surprising strategy of cold emails. Launched in 2023 and bootstrapped to $1M ARR, founder Adam Joseph targeted top media-savvy investors with a single beer-fueled cold email, ultimately catching Mark Cuban’s attention, who co-led the round. Cuban replied with a series of skeptical questions and a real-world product test, which Clipbook aced, proving its AI can differentiate context and nuance across text, audio, and video. Now serving 200 companies, including Boston Consulting Group and Weber Shandwick, Clipbook’s story offers some potential takeaways for founders: targeting the right investor, being bold enough to reach out, and having clear product proof can all make a difference. Who knew cold emails could deliver hot stuff?

Market Stirrings 🚩

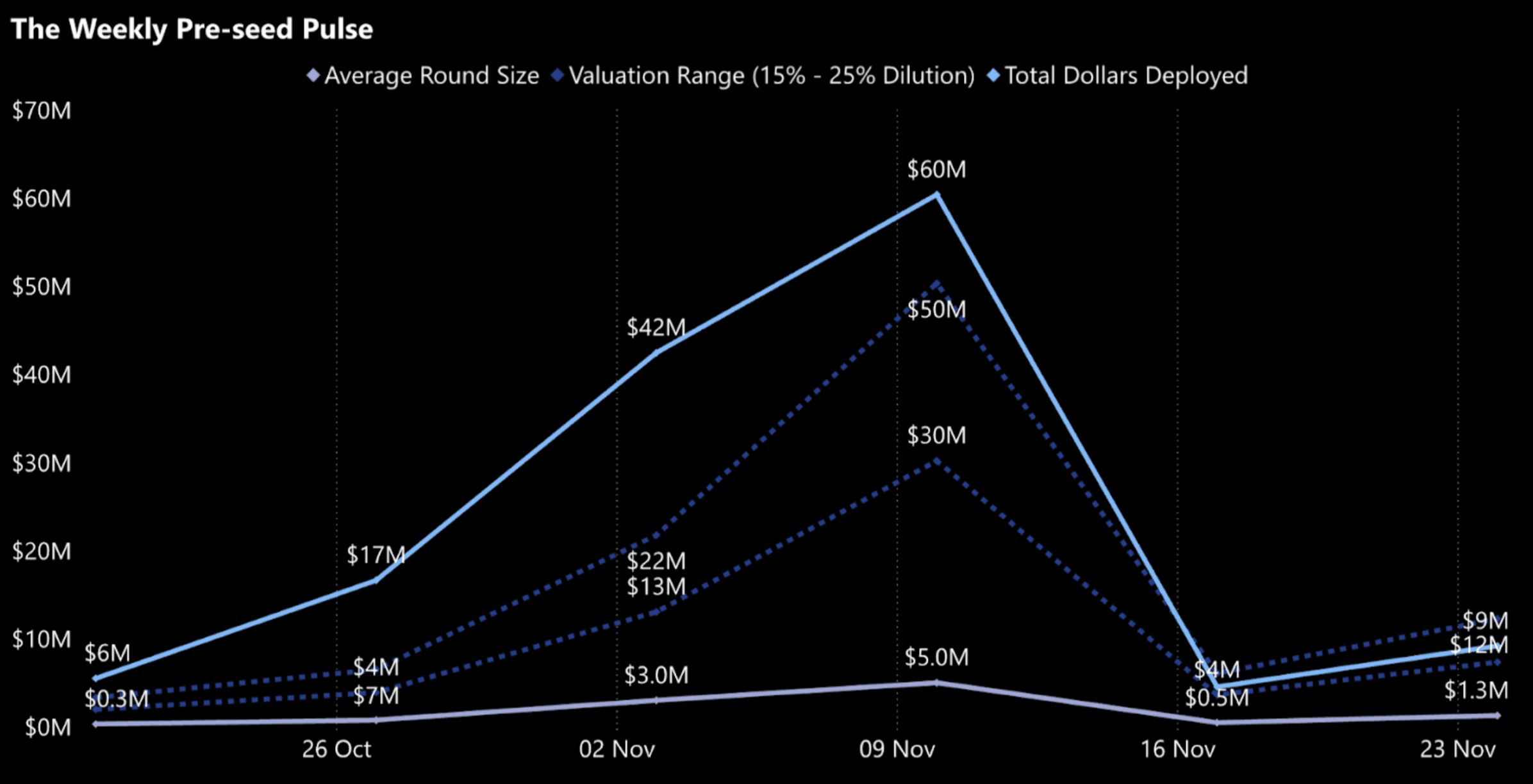

Here's what the week looked like in pre-seed:

$9.2M

7

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

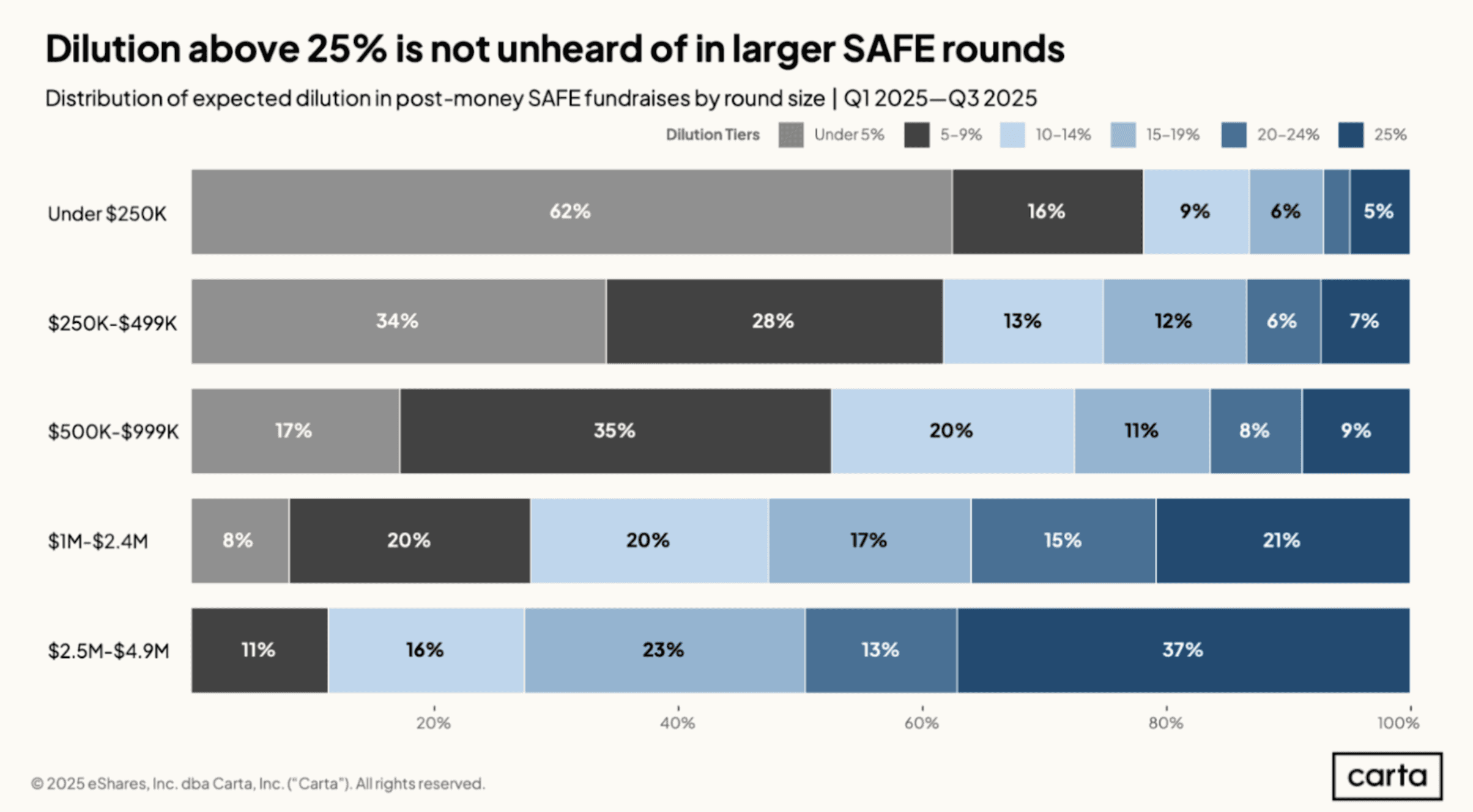

BREAKING INTO THE SAFE

Carta’s data shows a clear pattern: the bigger the SAFE, the bigger the bite on ownership. For rounds between $2.5M and $4.9M, roughly 37% of startups experience dilution of up to 25%, highlighting how even early-stage capital can significantly impact founder equity.

saas

SPhotonix - Bright ideas.

SPhotonix raised $4.5 million led by Creator Fund and XTX Ventures. SPhotonix is building ultra-dense 5D optical memory and advanced photonics to revolutionize data storage and high-precision optics.

defense tech

Thermopylae Aerospace - A ride on the tube.

Thermopylae Aerospace raised $1.6 million led by Naval Ravikant and UA1 VC. Thermopylae is creating ultra-light, modular drone interceptors to quickly and affordably counter glide bombs and strike drones.

AI

Sky Spy - Signal and deliver.

Sky Spy raised $1.6 million led by Expeditions Fund and Superangel. Sky Spy is developing battlefield-tested SIGINT technology that turns electromagnetic signals into actionable intelligence.

JOBORTUNITIES

| VP of Finance | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation.

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!