The best way to get rid of an overhang

Jan 29, 2026

Kaley Ubellacker

Happy Wednesday! If you’re new here, welcome to Necessary Nuggets, your one-stop pre-seed shop. We deliver updates from Necessary Ventures and helpful tidbits on our little corner of the world. Every edition is also on our blog.

What's happening at Necessary Ventures:

For Emerging GPs:

Catalyze opened applications for its 2026 Catalyze Fellowship Fund. The six-month program welcomes 5-10 first-time GPs across private markets, offering them 1:1 operational support and access to a network of experts, mentors, and LPs.

Good Reads 📖

For the rushed reader …

OpenAI’s research points to a 'capability overhang,' noting that power users engage with roughly seven times more advanced AI features than typical users.

TechCrunch wrote an interesting piece on HEN Technologies, an early-stage startup turning firefighting into a high-tech data play.

PitchBook reports that startup-on-startup M&A hit record highs in 2025, making up 38.4% of all US VC-backed company acquisitions.

For the less rushed reader …

How to cure an overhang

Stop asking ChatGPT to tell you a joke because it’s not playing anymore. OpenAI’s research points to a 'capability overhang,' noting that power users engage with roughly seven times more advanced AI features than typical users. Moreover, some countries show 3x higher per-person adoption of sophisticated tools. On the surface, it suggests a gap between what AI can do and how people use it, but it’s unclear whether it’s true untapped potential or simply that users haven’t found compelling applications for the tech yet. Across countries, leading adopters are in both high-income and emerging markets, proving that adoption is driven by factors beyond infrastructure or wealth, like workflow fit or organizational priorities. One question feels unanswered: if AI capabilities continue to grow faster than practical adoption, could it translate into meaningful productivity gains, or will users just keep searching for what actually works for them? The gap between power users and typical users is real enough to rethink how AI might scale across industries and economies. TLDR; AI’s got the brains, but it’s still waiting for bodies.

Fire drills

Forget smoke and mirrors; this startup is all smoke and models. TechCrunch wrote an interesting piece on HEN Technologies, an early-stage startup turning firefighting into a high-tech data play. After California’s wildfires hit near his home, founder Sunny Sethi leveraged his background in nanotech and solar research to build nozzles that put out fires faster while using less water. The breakthrough quickly expanded into a suite of smart devices feeding a cloud platform with firefighting data. The data, collected from sensors across 1,500 fire departments, the military, NASA, and 22 countries, is now powering AI models that predict fire behavior, turning hoses and sprinklers into intelligence tools. The startup rocketed from $200K in revenue in 2023 to $5.2M in 2025, with a projected $20M this year. The nozzles were the wedge, but the real asset emerging is the data they generate in the middle of real fires, under real conditions. You know it’s a great day for HEN when the data is spreading faster than the flames.

Two are better than one

There’s always another option when the situation seems IPO-ssible. PitchBook reports that startup-on-startup M&A hit record highs in 2025, making up 38.4% of all US VC-backed company acquisitions, or $31.1 billion of a $139.1 billion total. The trend is part of a new era where venture-backed companies, especially those seeing more cash and growth, are actively buying smaller peers to acquire talent, technology, and market share. The acquisitions often happen in AI-driven sectors like logistics, medical search, and reinforcement learning. The deals are giving smaller startups soft landings and creating more viable paths to growth, especially as the IPO bar has risen from ~$150 million to over $500 million in revenue. The wave of acquisitions highlights both the opportunity, and maybe pressure, to scale quickly or get scooped up by a bigger private player. Why raise another round when you can raise another startup?

Market Stirrings 🚩

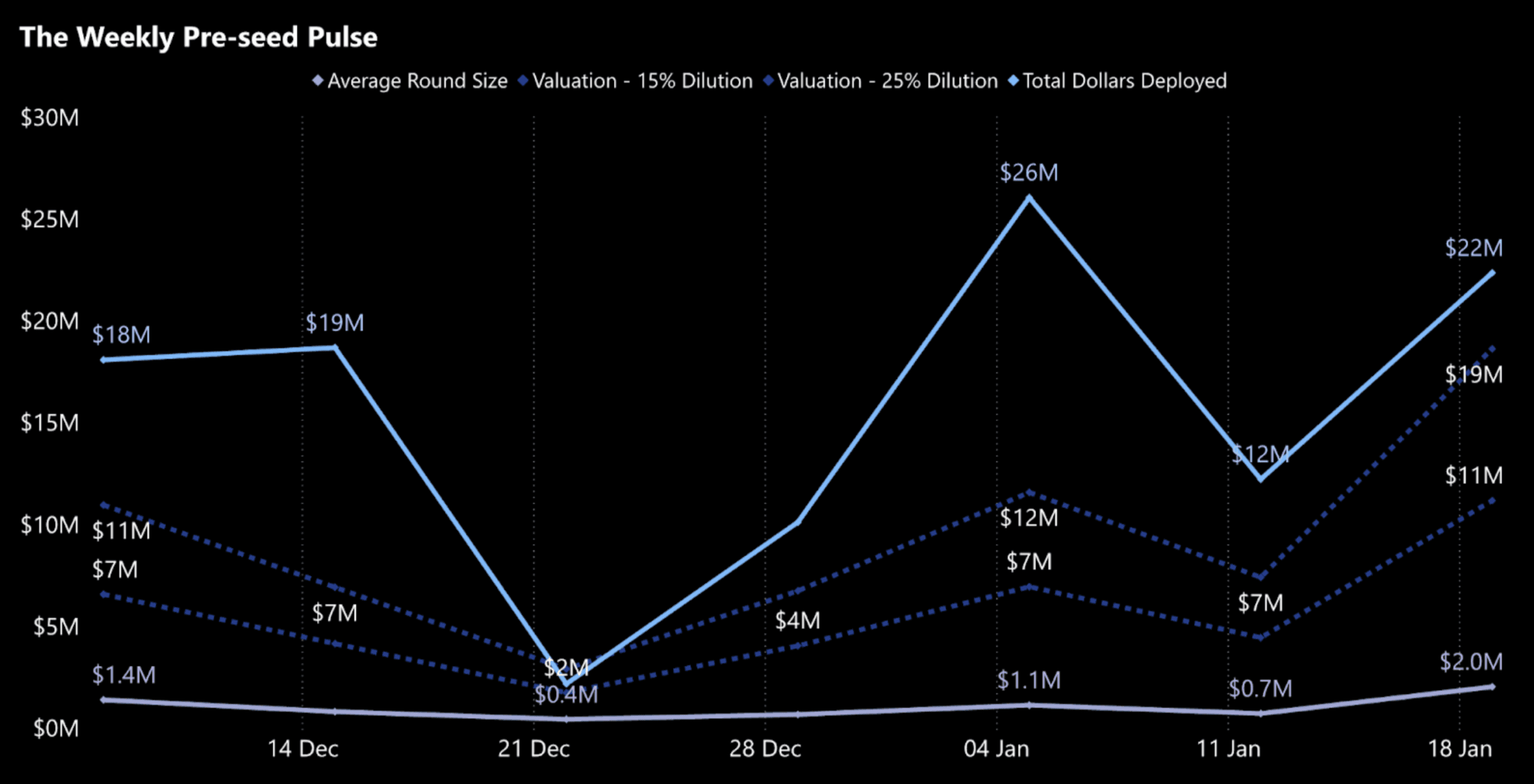

Here's what the week looked like in pre-seed:

$22.4M

11

Data aggregated from proprietary research and Crunchbase; valuation estimate based on 10-20% ownership stake.

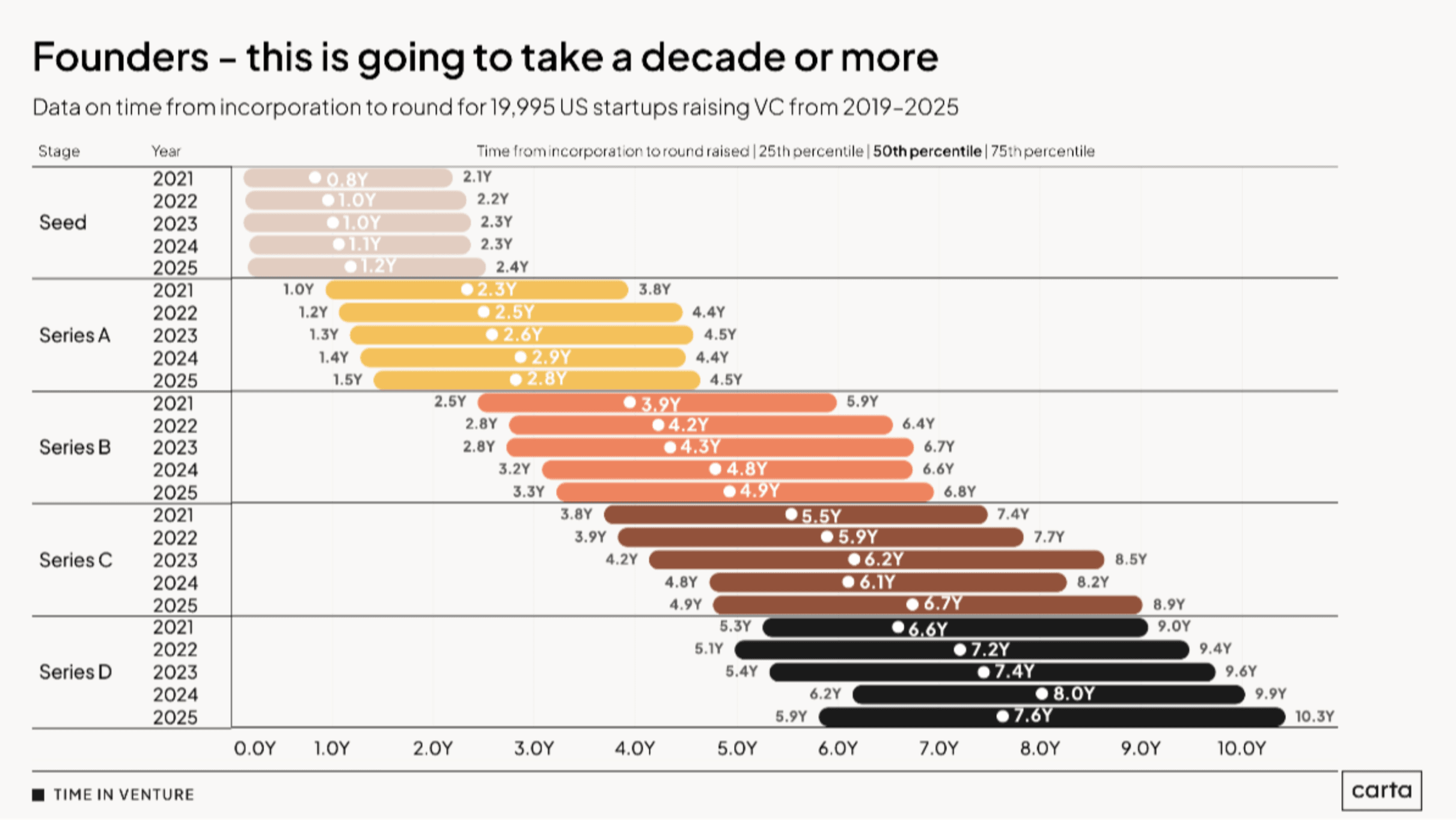

THE DECADE PARTY

Fundraising timelines are shifting, particularly in later-stage rounds. The median time to close a seed round rose 9% year-over-year, while the median for Series D dipped 5%. The range between the 25th and 75th percentiles continues to widen.

saas

Breez AI - AI found its calling.

Breez AI raised $1.3 million led by Wamda Capital. Breez AI is building a no-code voice infrastructure platform that lets businesses deploy reliable, real-time Voice AI at scale.

AI

Playad - Lights, camera, iteration.

Playad raised $5.4 million led by BRV Capital Management, Mirae Asset Venture Investment. Playad is creating an AI-powered creative platform to help teams ship creative faster by bringing image, video, and interactive production into one system.

AI

RiskFront - Due diligence minus the due date.

RiskFront raised $3.3 million led by Lytical Ventures. RiskFront AI is building an agentic AI platform that automates core fraud and compliance workflows.

JOBORTUNITIES

| VP of Finance | - Copper:

Rethinking the induction stove and making kitchen electrification more accessible than ever. Picture a fossil-free future, without sacrificing aesthetics.

| Full Stack Software Engineer | - OneImaging:

Envisioning the future of transportation beyond cars and into the realm of personal electric vehicles. Its first product, P1, is the ultimate tool for city navigation.

Outro🚪

Have any questions, feedback, or comments? Just reply here. We iterate and curate the newsletter according to your interests!

Some last matters of business:

If you’re a technologist (engineer or product manager / designer with a technical background) join us on the NVTC LinkedIn group if you haven’t. We’d love to have you!

Sign up here if you’re interested in co-investing with Necessary.

If you’re a startup founder, we’d love to help where we can! Brex provides full-stack finance solutions for startups. Sign up via Necessary and get bonus points.

Thanks for reading, and see you next week!